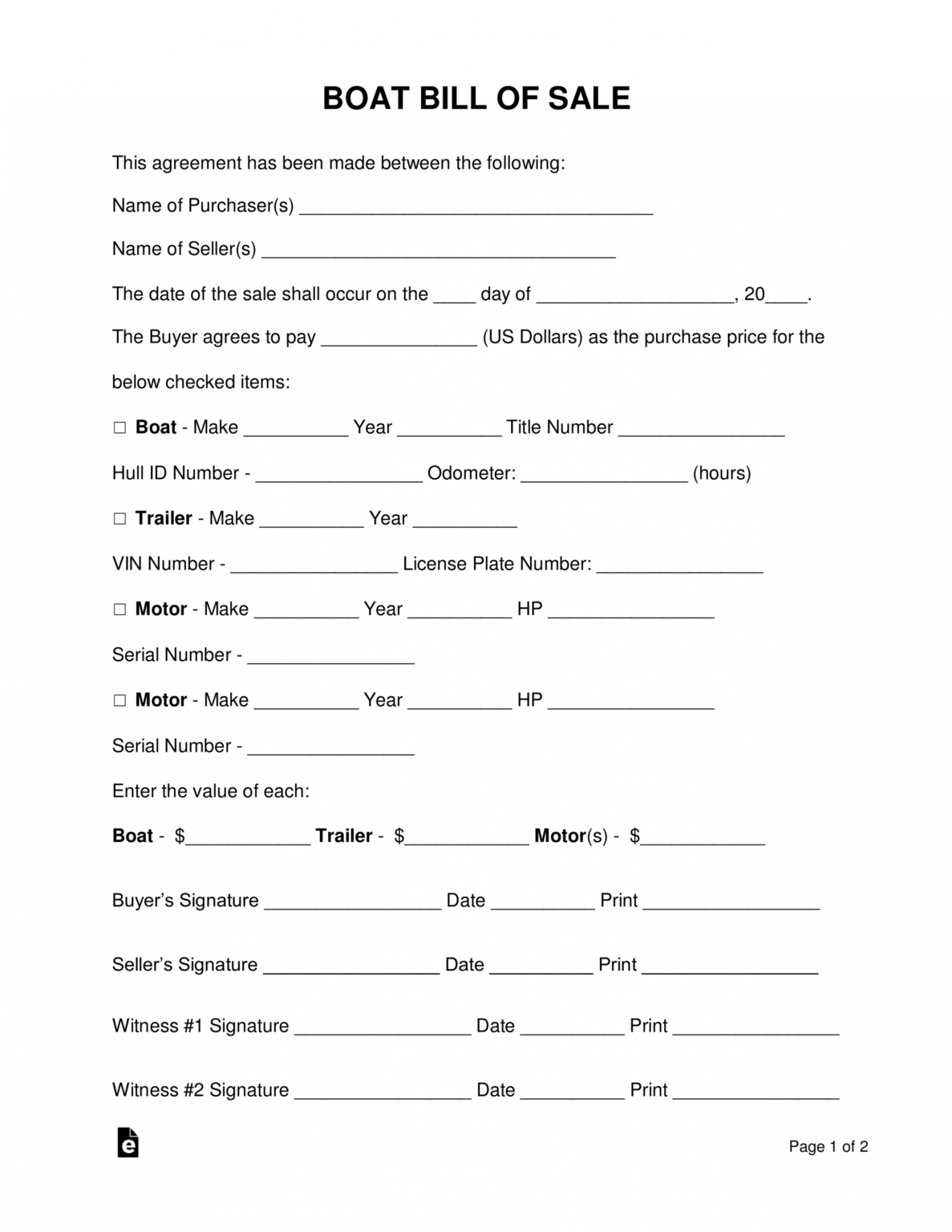

So you, as the buyer, will only pay sales tax on the boat itself to the DMV. So, for example, if your bill of sale reflects $250,000, but $75,000 is separately itemize for the two 250 horsepower outboard engines on the boat - then the DMV is not going to charge you sales tax on the outboard engines.. One of three forms must be used to pay tax or prove that no tax is due: Form RUT-25, Use Tax Transaction Return, due no later than 30 days after the date the watercraft or snowmobile is brought into Illinois or the date of purchase from an out-of-state dealer or retailer, lending institution, or leasing company selling at retail.; Form RUT-75, Aircraft/Watercraft Use Tax Transaction Return.

Boat Bill Of Sale Template Word

One of the great things about property is that in some cases the that you earned can be

Sales Tax by State Here’s How Much You’re Really Paying Sales tax, Tax, Filing taxes

Do you Pay Tax When You Sell Your Main Residence? Ashtons Estate Agency

Do You Pay Vat On Imports? The 15 Detailed Answer

Do You Pay Tax On Isa Withdrawal Tax Walls

Free Boat Trailer Bill Of Sale Form Download Pdf Word with regard to Credit Sale Agreement Te

Do I pay tax on Bitcoin gains? Arthur Hamilton

DO YOU PAY TAXES ON DIVIDENDS? An Explanation of How Dividends are Taxed YouTube

Do You Pay National Insurance on an Apprenticeship? Complete Apprenticeship Guide

TAX ON FTMO [DO YOU PAY TAX ON FTMO? WHAT UK TAX DO YOU PAY ON FTMO ONCE PASSING THE FTMO

At What Rate Do You Pay Tax on Dividends? Retirement

Do You Pay Tax On Pension Benefits

In 1 Chart, How Much the Rich Pay in Taxes 19FortyFive

Do You Pay Tax On Negatively Geared Properties? (Ep255) YouTube

Do You Pay Tax On Salary Sacrifice Cars Fleet Evolution

Do you pay tax when you sell your house UK? YouTube

Do You Pay Tax on Bitcoin? Lesson 9 YouTube

TaxClaimable Expenses Annie

Do You Pay Sales Tax On A Leased Car Buyout? Bankrate

If you do not pay sales tax to a registered dealer in Massachusetts, a 6.25% sales tax is due by the 20th day of the month following the: Purchase; Use; Storage or; Other consumption. For example, if you buy a boat in Massachusetts on June 1, sales tax would be due by July 20. Private sales made outside of Massachusetts. The 3 Main Types of Taxes that Boat Owners Pay First, there's the sales tax, which you likely will have to pay when you buy the boat.This sales-tax rate varies from state to state, and the swings can be big. Delaware and Rhode Island do not require a sales tax at all, and in some states, sales tax is only applied up to a certain amount of the boat's purchase price.