For example, when the PCI DSS was first established in 2006, merchants did not widely use mobile devices to accept card payments. Since January 31, 2018, PCI DSS 3.2 was in effect, and it has already been revised (i.e., PCI DSS version 4.0). Now that those things are solid requirements, they all need to be met and attested to.. How often are PCI DSS audits required? Level 1 businesses must complete a PCI validation form annually and undergo an annual audit conducted by a qualified auditor. This requirement is mandated by the PCI DSS and applies regardless of how card data is accepted - in-person, online, or mobile.

A Full PCI DSS Requirements Checklist for Your Application’s Back End and Front End RubyGarage

PCI Compliance Levels A Complete Guide Softjourn, Inc.

How to Prepare for a PCI DSS Audit

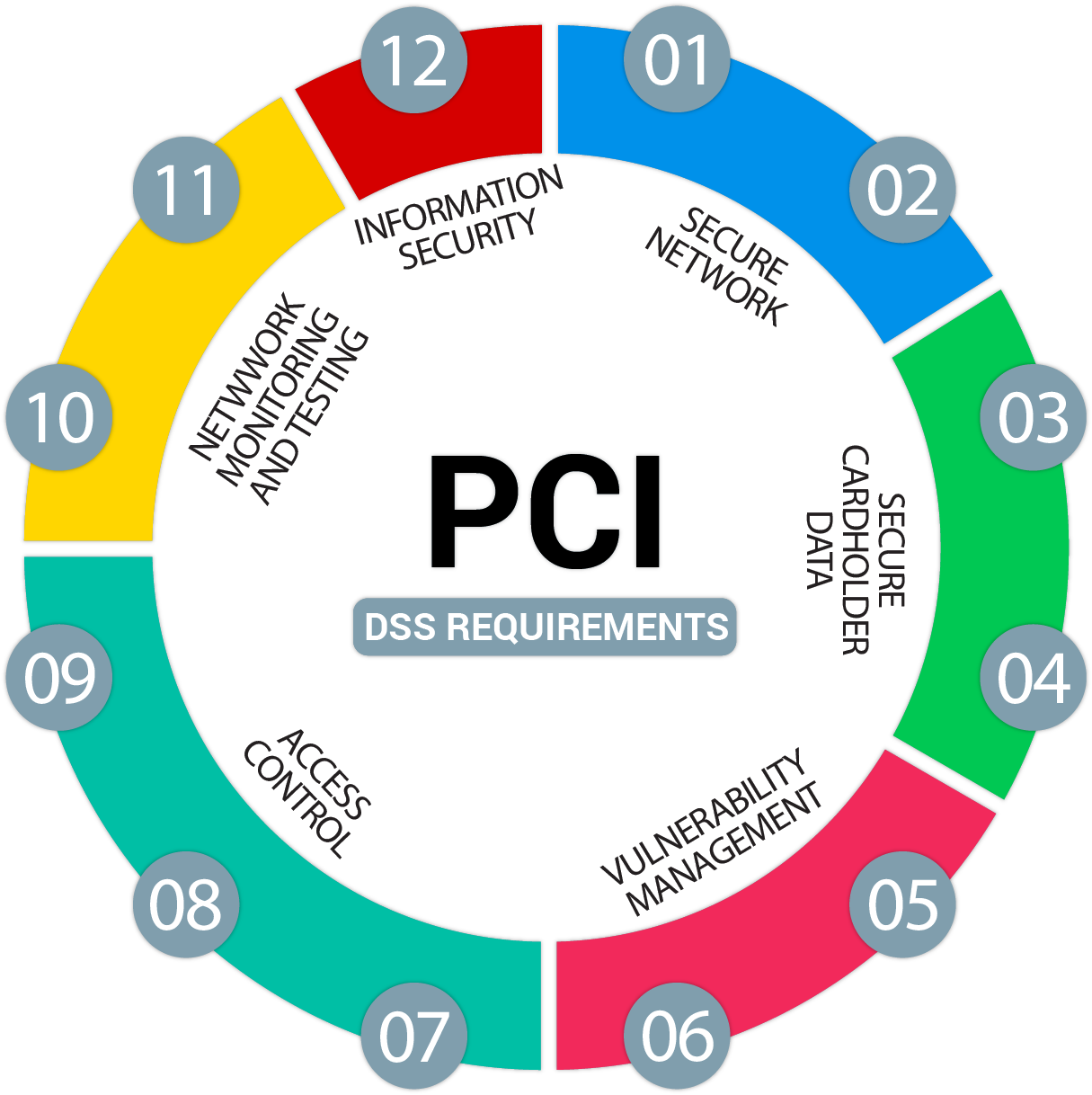

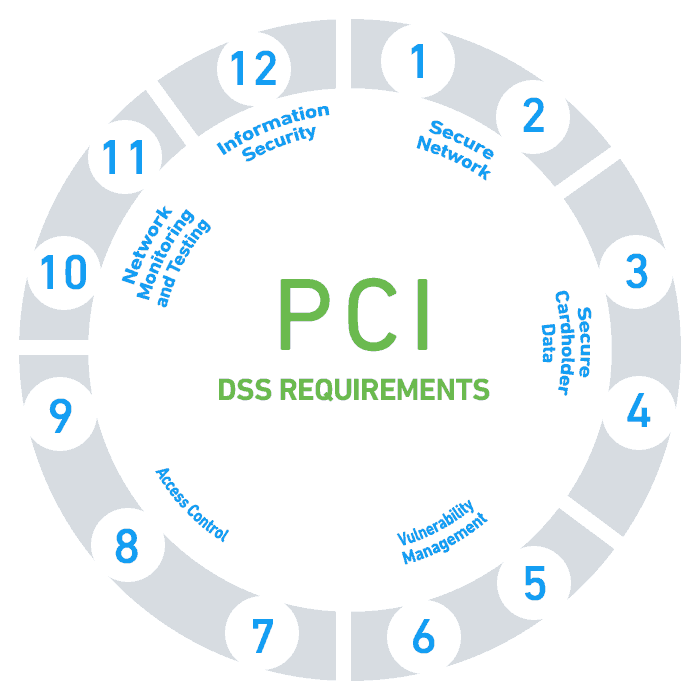

PCI DSS requirements

What Is PCI Compliance? Fraud Definitions

Roadmap To Achieving The PCIDSS Certification InfosecTrain

PCI DSS Requirements What You Need to Know Auditwerx

The PCI DSS Audit Key Requirements & 7 Steps for Preparation Ekran System

PCI DSS Audits An Essential Guide MeritLine

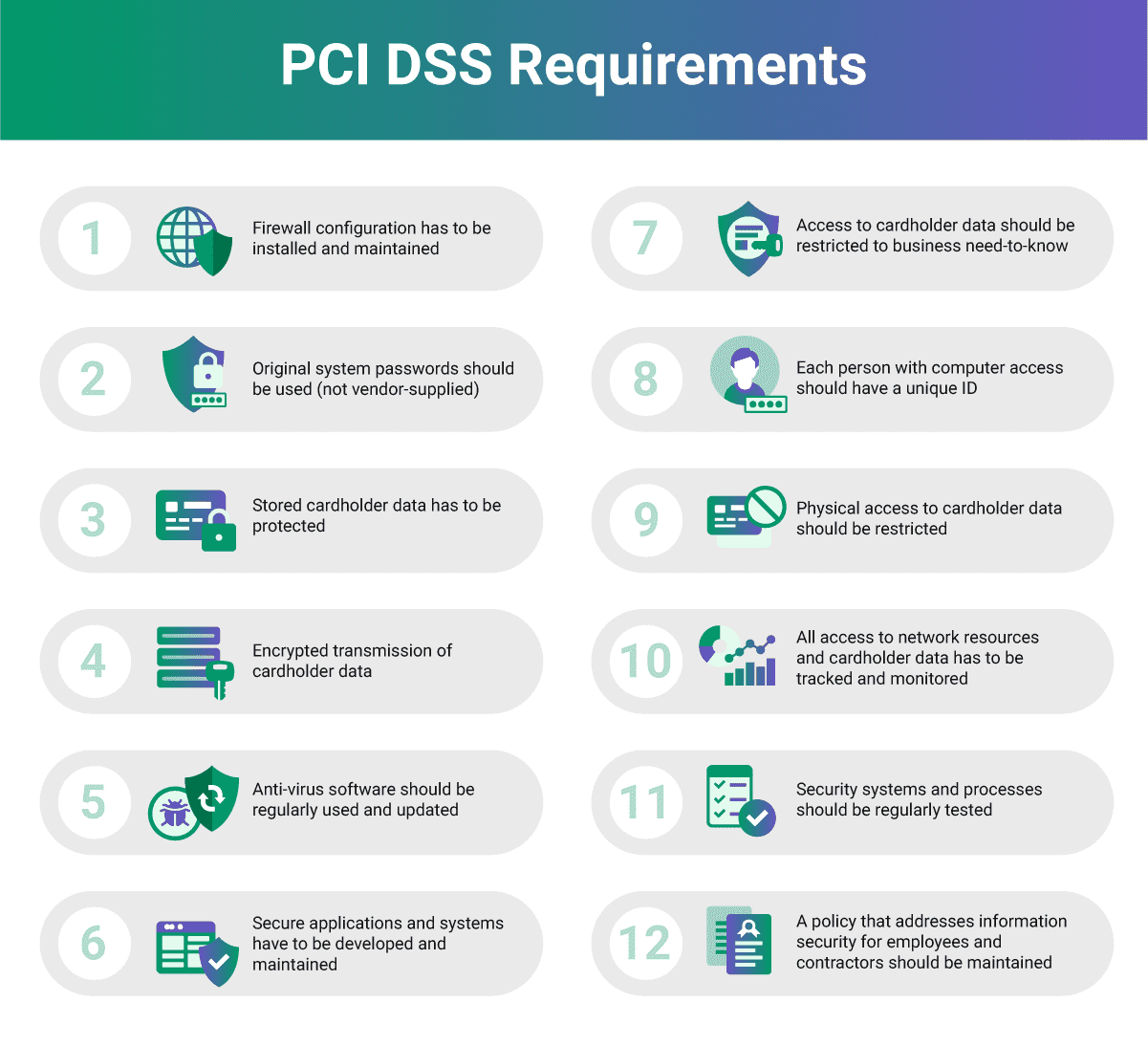

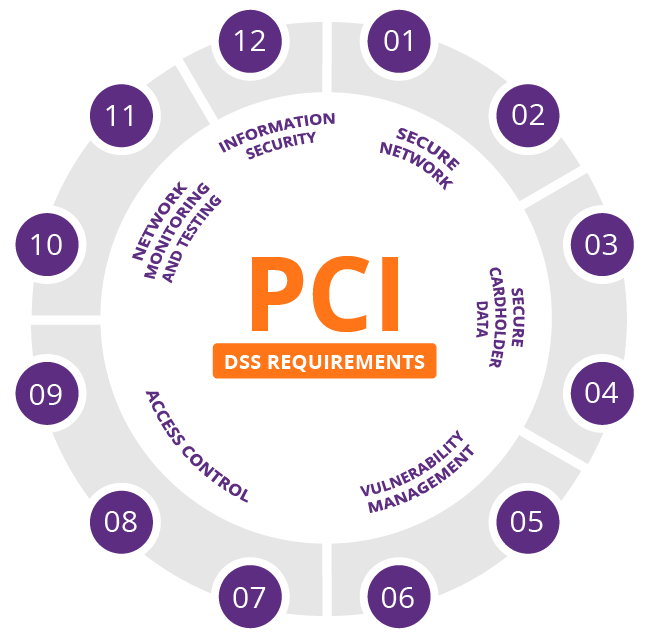

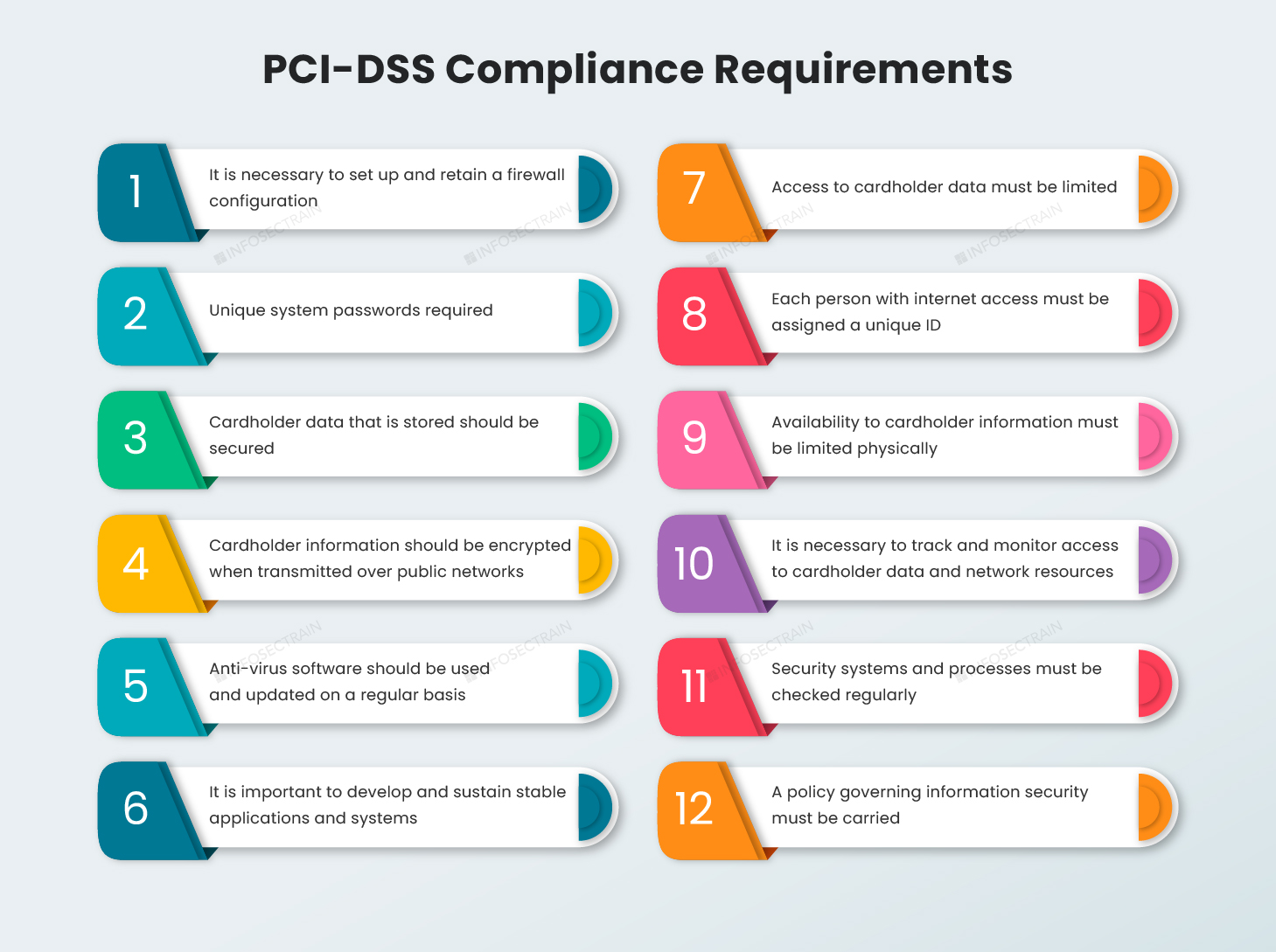

The 12 PCI DSS Requirements 4.0 Compliance Checklist

PCI DSS Compliance Checklist Your Guide to Security 2024

PCI DSS Compliance Requirements All Regulations Explained

PCI DSS Compliance Requirements Checklist DNSstuff

PCI DSS Compliance Requirements Checklist DNSstuff

Certified PCI DSS integration DuploCloud

A 32Step PCI Compliance Checklist for Reference and SelfAudit

PCI Compliance A Quick Guide with PCI Standards

PCI DSS Annual Audit Requirements Vista Infosec

Level 1 PCI Compliance What It Is & What You Need to Know

How to Be PCI DSS Compliant An Information Guide for Your Salesforce Org

Web application tests - annual web application testing is required to meet the reporting and testing requirements of the PCI DSS Requirement 6.6. Vulnerability scans - assesses your external network systems via an authorized scanning provider to adhere to PCI DSS Requirement 11.2. Plan to carry out an ASV scan quarterly.. Organizations that focus solely on annual PCI DSS assessments to validate the quality of their cardholder data security programs are missing the intent of PCI DSS to enhance cardholder data security, and likely see their PCI DSS compliance state "fall off" between assessments (see Figure 1).