As a result, commission income from foreign principals could be subject to 5 per cent VAT. Under the old rules, services to a foreign principal who did not have a place of residence in the UAE.. This short Briefing Note summarises VAT law in the UAE and the absolutely essential points of which foreign companies should be aware.. Background. The 6 Gulf Cooperation Council (GCC) states entered into a Value Added Tax (VAT) Treaty in 2016 which led the way for the introduction of VAT in the Gulf region.It was a complex treaty setting out the principles of VAT to be adopted in similar.

VAT Courses in Dubai VAT Training in Dubai VAT Learning

About UAE VAT 10 Things you must know

Certificate in Dubai / UAE / GCC VAT Major Accounting Institute

A Comprehensive Guide on How To Registration for VAT in Dubai, UAE Vat in uae, This or that

VAT Registration Services in Dubai UAE Updated in 2023

VAT certification in Dubai Dubai Free zone Blog

Documents Required for VAT registration in Dubai, UAE

VAT Related Services in Dubai, UAE KLOUDAC

Know Everything About Dubai UAE VAT Horizon Biz Consultancy

What is VAT in UAE — Tax Consultancy in Dubai Vat in uae, Tax, Tax services

Understand the VAT refund in Dubai Dubai, Around the worlds, World

vat consultancy services Dubai, VAT in UAE, VAT Filing services Elevate

Documents Required for VAT registration in Dubai, UAE (Updated)

VAT Registration in UAE 2 Invest House

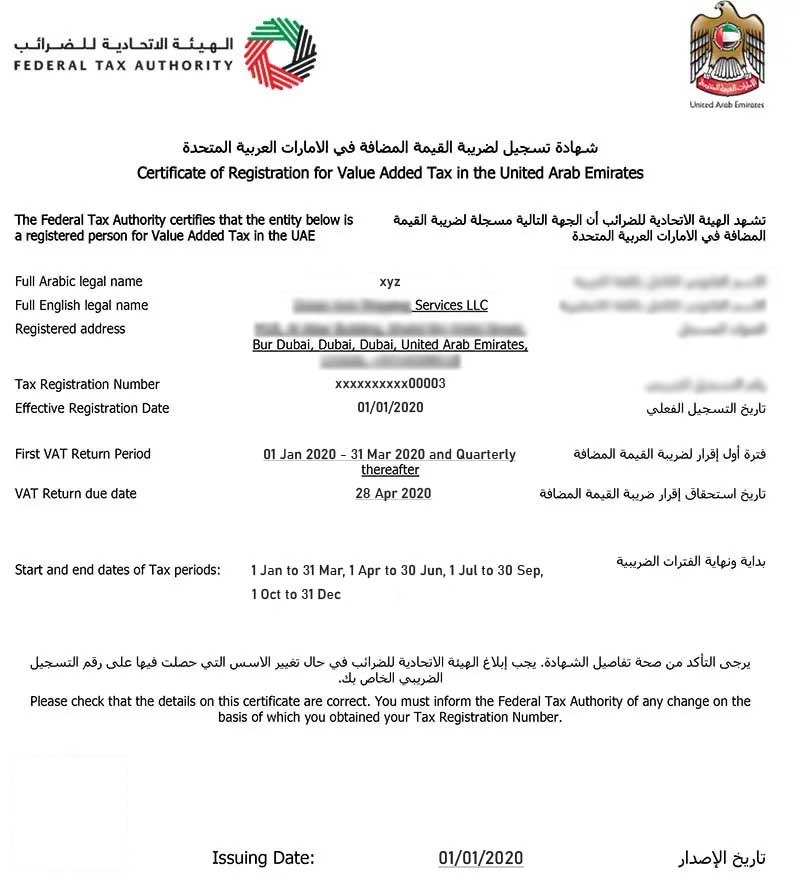

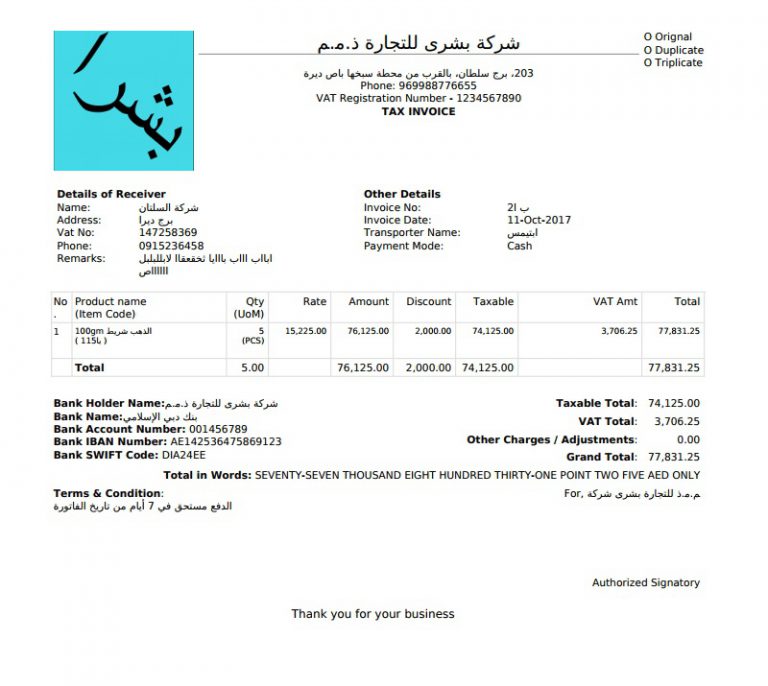

Contents of UAE VAT Tax Invoice As Per the Guidelines of FTA ExcelDataPro

![What Is Vat In Dubai? [The Right Answer] 2022 TraveliZta What Is Vat In Dubai? [The Right Answer] 2022 TraveliZta](https://www.travelizta.com/wp-content/uploads/2022/09/what-is-vat-in-dubai.jpg)

What Is Vat In Dubai? [The Right Answer] 2022 TraveliZta

Detailed guide to UAE VAT registration services in Dubai

UAE VAT VAT Applicability in Dubai

The VAT in Brief, 10 Things all Dubai Residents Should Know

VAT update in DubaiUAE Accounting & Audit Firms in Dubai, UAE

Concluding Remarks: The question Is VAT applicable on services in UAE? can simply be answered with strong Yes. VAT is applicable on any business activity that is undertaken within the country (United Arab Emirates). It is irrelevant that whether in such supply tangible goods are transferred or not. The only point to consider is whether some.. Value Added Tax (VAT) is an indirect tax, which is imposed on most supplies of goods and services that are bought and sold. 2. Why is the UAE imposing VAT? The implementation of VAT in the UAE will contribute to the 'continued provision of high quality public services into the future', the Ministry of Finance explains.